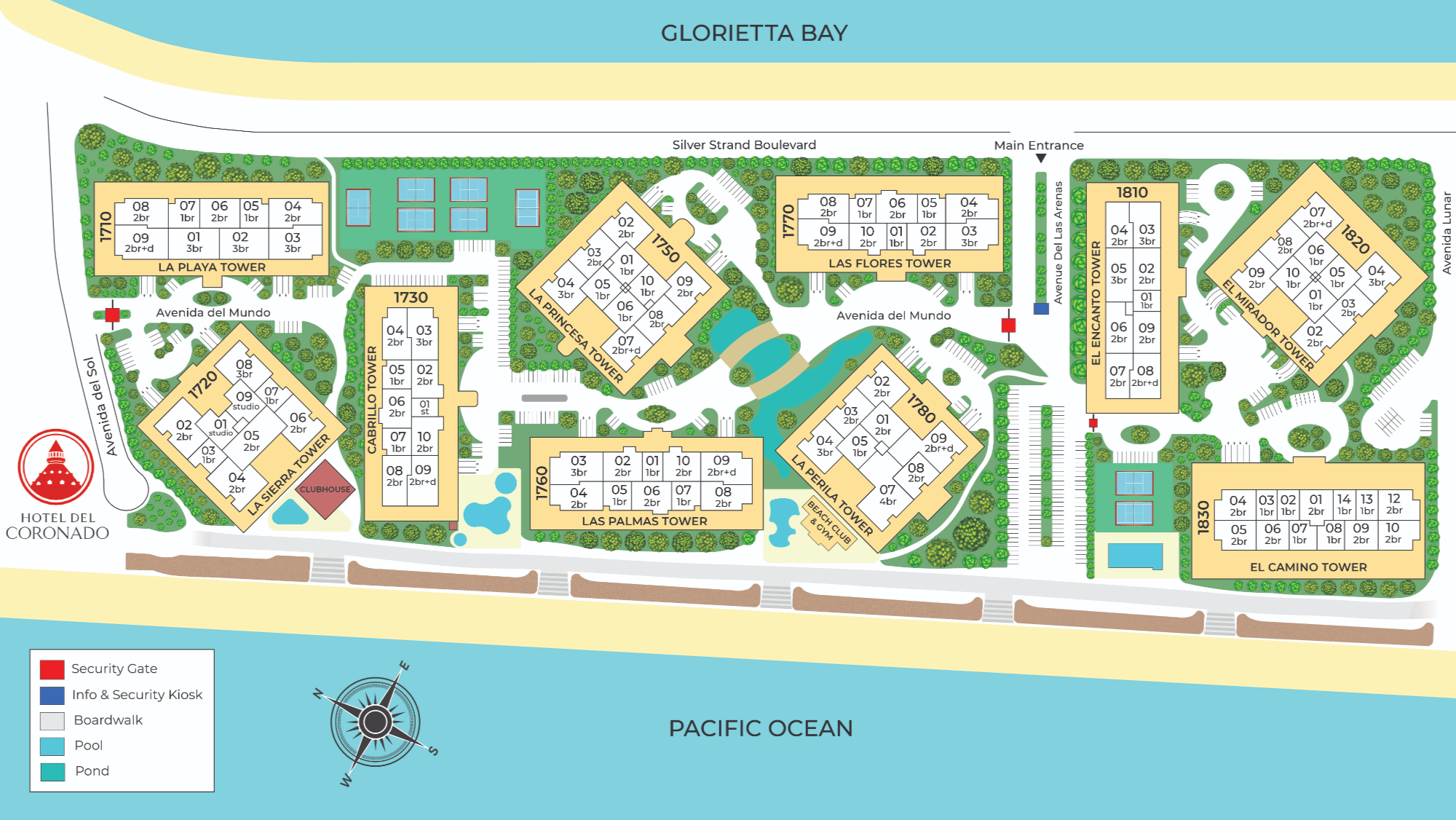

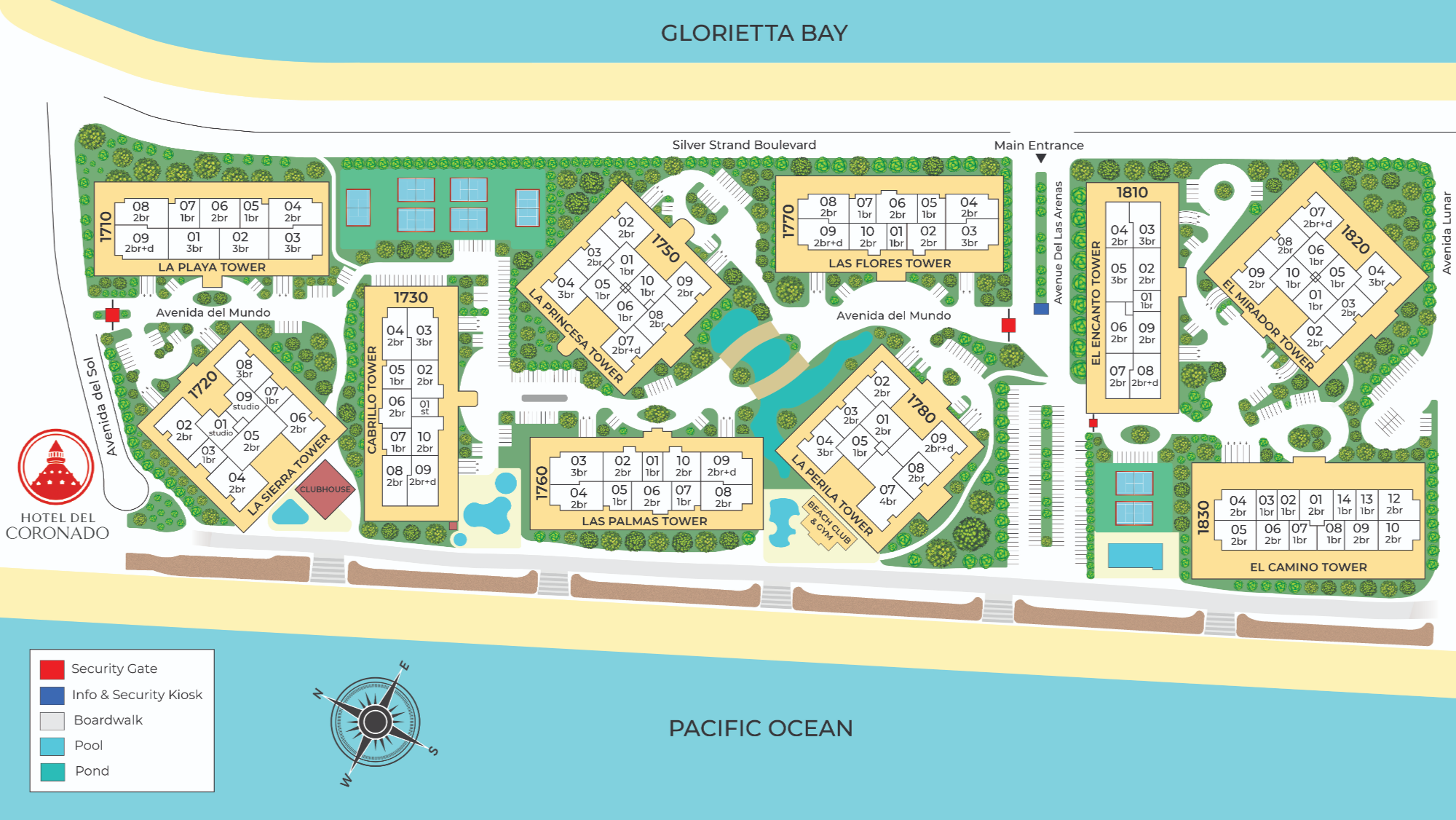

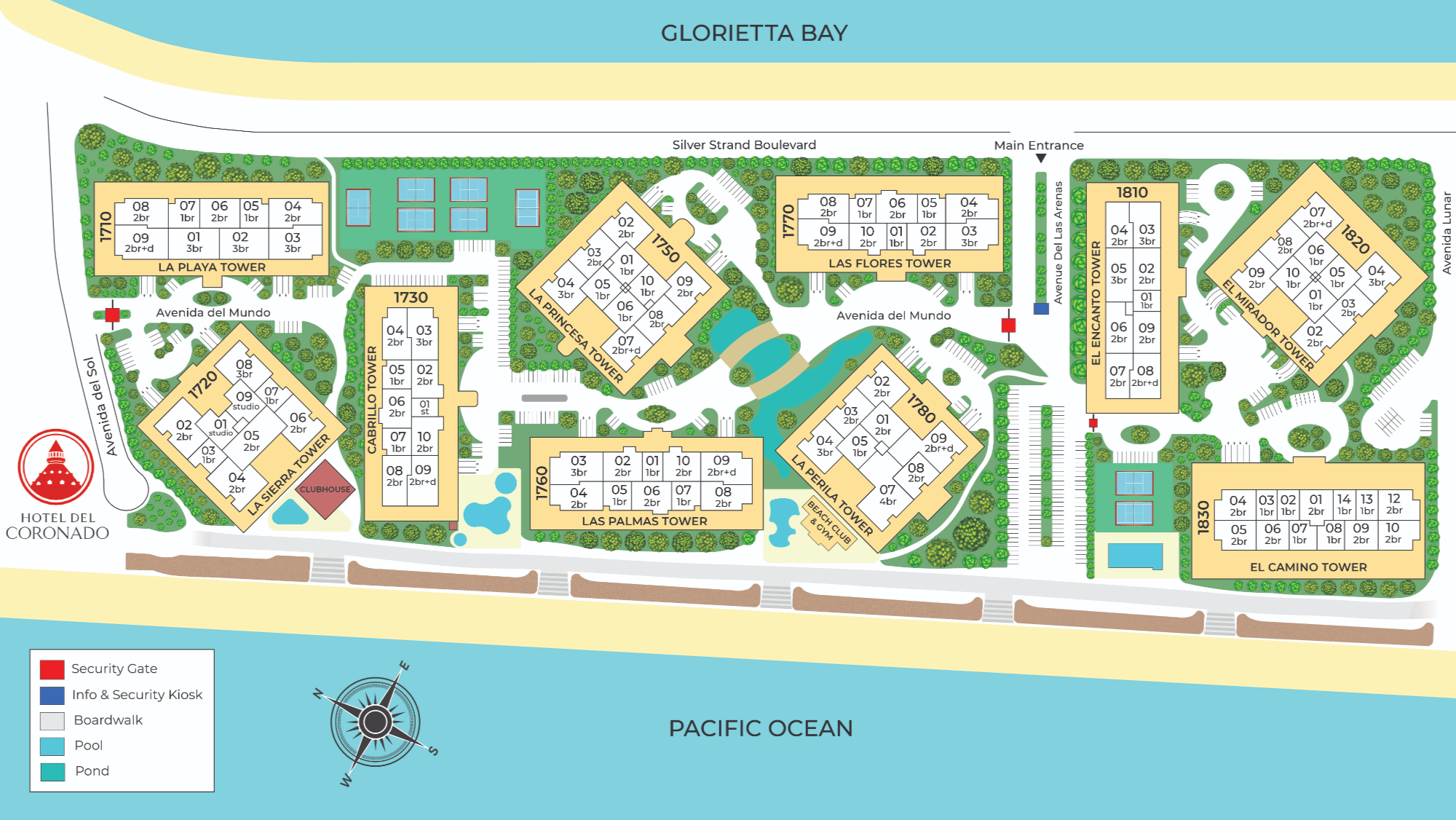

The Coronado Shores Condo Community Consists of 10 Towers:

Cabrillo Tower (1730 Avenida del Mundo)

The Cabrillo Tower at the Coronado Shores was the first of the ten towers constructed in Coronado Shores and was completed in 1970. This 15-story Coronado condominium tower offers a quality living experience with the help of its supporting cast. A large majority of these Coronado condos offer excellent views. The tower is one of two towers that run perpendicular to Coronado Beach. This Coronado condo community is located in the north portion of the neighborhood. The tower’s orientation offers endless views of the Pacific Ocean anchored by Point Loma to the north. Residents in east-facing units overlook the San Diego Bay, Glorietta Bay, and Coronado Bridge. Cabrillo Tower has within arms reach to the Coronado Shores clubhouse, two impressive pools, and eight very well-maintained regulation tennis courts. Each of the 15 floors contains 10 units offering one, two, and three-bedroom layouts.

La Sierra Tower (1720 Avenida del Mundo)

La Sierra Tower at the Coronado Shores is the closest building to the Hotel Del Coronado that is directly on the ocean, giving it the premier location in all the Coronado Shores community. Fine dining, boutique shopping, and pristine sandy beaches are all within walking distance. Each floor consists of 9 units, and offers studios, one, two, and three-bedroom layouts. La Sierra is one of only two towers that feature studio units.

Las Palmas Tower (1760 Avenida del Mundo)

Las Palmas Tower at the Coronado Shores was the 3rd tower constructed in the Coronado Shores and was completed in 1973. Las Palmas is a superb 15-story luxury condominium tower that offers magnificent views and a distinct experience. The tower runs parallel to the boardwalk and offers terrific ocean views as well as views of the San Diego landscape that incorporate the Coronado Bridge, Coronado Cays, San Diego Bay, and the impressive rolling hills south of the border. Each of the floors contains 10 units offering one, two, two + a den, and three-bedroom layouts.

La Flores Tower (1770 Avenida del Mundo)

The Las Flores Tower was the 4th Tower constructed in the Coronado Shores and was completed in 1973. Las Flores is a magnificent 15-story Coronado condo tower that provides a quality living experience that rivals any tropical vacation. Las Flores offers abundant, views of the ocean to the west, and the bay and downtown San Diego to the east. Each of the 15 floors contains 10 units offering one, two, two + a den, and three-bedroom layouts.

El Camino Tower (1830 Avenida del Mundo)

El Camino Tower at Coronado Shores was the fifth tower constructed in Coronado Shores and was completed in 1975. This building has the highest number of condos on each level. Each of the 15 floors contains 13 condos consisting of one and two-bedroom layouts. El Camino is located on the southwest corner of the complex and runs parallel to the boardwalk. It provides endless views of the Pacific Ocean from the west-facing side of the building.

La Playa Tower (1710 Avenida del Mundo)

La Playa Tower was the 6th condo tower constructed in the Coronado Shores and was completed in 1976. There are 15 stories in this illustrious tower which provides breathtaking views of Downtown San Diego and San Diego Bay. The tower’s location makes it an easy walk into to the Village for shopping and dinning. Each of the 15 floors contains 9 units offering one, two, two + a den, and three-bedroom layouts.

La Perla Tower (1780 Avenida del Mundo)

La Perla Tower was the seventh condo community constructed in Coronado Shores and was completed in 1976. The 121-condo tower sits in the center of the Coronado Shores Community, overlooking the Beach Club and main pool area. La Perla Tower provides a vantage point that brings endless views as the sunsets into the Pacific Ocean, the immaculate Coronado Bridge, and the San Diego Bay. La Perla is the only building in the community that offers a 4 bedroom layout that overlooks the Pacific Ocean. Each of the 15 floors contains eight units offering one, two, two +a den, three, and four-bedroom floor plans.

El Encanto Tower (1810 Avenida del Mundo)

El Encanto Tower was the 8th tower constructed in the Coronado Shores and was completed in 1977. They are completing a full renovation of their lobby and common areas in 2022. This 15-story condominium tower is located parallel to the main entrance into the Coronado Shores community. Each of the 15 floors contains 9 units offering one, two, two + a den, and three-bedroom layouts.

El Mirador Tower (1820 Avenida del Mundo)

El Mirador Tower was the ninth condo tower constructed in the Coronado Shores and was completed in 1978 and it is located on the Southeast corner of the community. The panoramic views from the El Mirador tower range from the Mexican foothills to the marvelous skyline of Downtown San Diego. Each of the 15 floors contains 10 units offering one, two, two + a den, and three-bedroom floorplans.

La Princesa Tower (1750 Avenida del Mundo)

La Princesa Tower was the 10th, and the last tower constructed in the Coronado Shores Condo community and it was completed in 1978. La Princesa is a 15-story luxury condominium tower that bestows a top-quality living experience. The tower is located in the middle of the community and offers wonderful views depending on the orientation. Residents of La Princesa enjoy panoramic ocean views to views of the ocean or the San Diego Bay. Each of the 15 floors contains 10 units offering one, two, two + a den, and three-bedroom layouts.

Map Of Coronado Shores Buildings